Get the free irs form 8879 for 2012

Show details

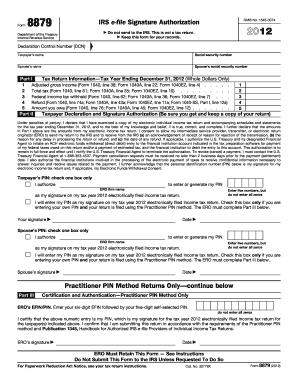

Form 8879-I IRS e-file Signature Authorization for Form 1120-F For calendar year 2012, or tax year beginning, 2012, ending, 20. Information Do not send to the IRS. Keep for your records. About Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs form 8879 for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 8879 for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 8879 for online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs form 8879 for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out irs form 8879 for

How to fill out IRS Form 8879:

01

Obtain a copy of IRS Form 8879 from the official IRS website or your tax preparer.

02

Read the instructions provided with the form carefully to ensure you understand the requirements and steps involved in filling it out.

03

Provide your personal information in the designated sections of the form, including your name, Social Security number, and address.

04

Enter your Electronic Filing Identification Number (EFIN) if applicable.

05

If you are using a tax preparer, ensure they have entered their Preparer Tax Identification Number (PTIN) and signature in the appropriate fields.

06

Review the information you have entered to ensure it is accurate and complete.

07

Sign and date the form.

08

Submit the completed form to the appropriate party, whether it's the IRS or your tax preparer, as instructed.

Who needs IRS Form 8879:

01

Taxpayers who have chosen to electronically file their federal tax return via IRS e-file may need IRS Form 8879.

02

Tax preparers who are e-filing tax returns on behalf of their clients will also require IRS Form 8879.

03

The form serves as an authorization and signature authorization document for electronically filed tax returns.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs form 8879 for?

IRS Form 8879 is used to authorize an electronic return filing. It is called the IRS e-file Signature Authorization and is commonly used by taxpayers when they file their federal income tax returns electronically through an Electronic Return Originator (ERO). This form serves as consent and authorization for tax practitioners to sign and submit the electronically filed return on behalf of the taxpayer.

Who is required to file irs form 8879 for?

Form 8879 is required to be filed by tax preparers, specifically, Electronic Return Originators (EROs). EROs are tax professionals or firms that electronically file tax returns on behalf of their clients. The form serves as the Internal Revenue Service (IRS) e-file Signature Authorization form, allowing EROs to confirm that their clients have approved and verified their tax return information.

How to fill out irs form 8879 for?

IRS Form 8879, also known as the IRS e-file Signature Authorization, is used by taxpayers to authorize an electronic return originator (ERO) to electronically file their tax return with the IRS. This form is typically used when filing personal income tax returns electronically through a tax professional or tax software. Here are the steps to fill out Form 8879:

1. Obtain the form: You can download Form 8879 from the official IRS website or obtain it from your tax professional or tax software.

2. Provide personal information: Fill in your personal information, including your name, Social Security Number (SSN), address, and the tax year you are filing for.

3. Enter ERO information: If you're working with a tax professional, they will provide their information. If you're using tax software, this information will be auto-filled for you.

4. Signatures: Both you (the taxpayer) and the ERO must sign and date the form. The ERO must also provide their Electronic Filing Identification Number (EFIN) or Practitioner PIN.

5. Retain a copy: Keep a copy of the completed Form 8879 for your records.

Note: The ERO will keep the signed Form 8879 as part of their records, and they may ask you to provide a copy or physically sign it if you’re filing through a tax professional.

It's essential to follow the instructions included with the form and consult with a tax professional if you have any specific concerns or questions regarding your tax situation.

What is the purpose of irs form 8879 for?

IRS form 8879 is used for electronically signing and verifying tax returns filed using an electronic filing method such as e-file or electronic submission. It authorizes an electronic return originator (ERO) to transmit an individual or business tax return to the Internal Revenue Service (IRS) for processing. This form ensures that the taxpayer has reviewed and approved the return before submission and provides consent for the ERO to file the return electronically on their behalf.

What information must be reported on irs form 8879 for?

IRS Form 8879 is used to authorize an Electronic Return Originator (ERO) to electronically file an individual or business tax return with the IRS. Here is the information that must be reported on Form 8879:

1. The taxpayer's name and signature: The form must include the taxpayer's full name, as listed on the tax return, and their signature authorizing the ERO to electronically file the return.

2. The Preparer's Tax Identification Number (PTIN): The PTIN of the tax professional who prepared the return must be provided.

3. The ERO's name, address, and Electronic Filing Identification Number (EFIN): The ERO's information, including their name, business address, and EFIN, is required to identify the authorized electronic filer.

4. The tax year: The form must indicate the tax year for which the return is being filed.

5. The type of return being authorized: The specific form number or description of the return being authorized for electronic filing must be provided.

6. Declaration and authorization: The taxpayer must declare that they have reviewed the return, attest to its accuracy, and authorize the ERO to electronically file it on their behalf.

It's important to note that Form 8879 does not include the actual tax return information; it is simply an authorization form. The tax return itself must be completed separately and attached or submitted in accordance with the IRS guidelines.

What is the penalty for the late filing of irs form 8879 for?

The penalty for late filing of IRS Form 8879 (e-file Signature Authorization) can vary depending on the circumstances. However, if the form is not filed on time, a Penalty for Failure to File may apply. According to the IRS, as of 2021, the penalty is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. It is important to note that this penalty can be reduced if the taxpayer has a valid reason for the late filing, such as reasonable cause or certain exceptions. It is always recommended to consult with a tax professional or refer to the IRS guidelines for more accurate and updated information regarding penalties.

How do I modify my irs form 8879 for in Gmail?

irs form 8879 for and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get irs form 8879 for?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific irs form 8879 for and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out the irs form 8879 for form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign irs form 8879 for and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your irs form 8879 for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.